Forex Business: Understanding the Ins and Outs of Foreign Exchange Trading

The forex market, also known as foreign exchange, is the largest financial market in the world. It involves the buying and selling of currencies, with the aim of making a profit from the fluctuations in exchange rates. Forex trading can be a lucrative business, but it requires skill, knowledge, and discipline to succeed. In this blog, we will explore the key aspects of forex trading and provide some tips for those looking to enter this exciting industry.

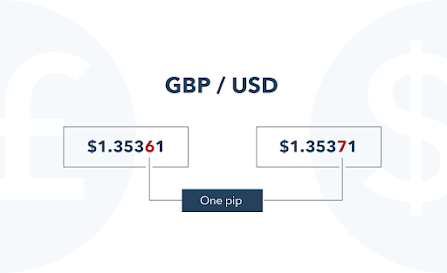

Forex trading involves the exchange of currencies between buyers and sellers. Each currency is represented by a three-letter code, such as USD for the US dollar, EUR for the euro, and JPY for the Japanese yen. The exchange rate between two currencies is the value of one currency relative to the other. For example, if the USD/JPY exchange rate is 110, it means that one US dollar is worth 110 Japanese yen.

Forex trading takes place in pairs, with the most popular being the EUR/USD, USD/JPY, and GBP/USD pairs. Traders aim to buy a currency when it is undervalued and sell it when it is overvalued. This is done by analyzing economic data, political events, and other factors that can affect currency prices. Forex traders can make money in both rising and falling markets, by going long or short on a currency pair.

To trade forex, you need to work with a forex broker. A forex broker is a company that provides access to the forex market and allows you to trade currencies. Choosing the right forex broker is crucial to your success in forex trading. Some of the factors to consider when choosing a forex broker include:

• Regulation: Ensure that the broker is regulated by a reputable financial authority. This will protect your funds and ensure that the broker is operating in a transparent and ethical manner.

• Trading Platform: Look for a broker with a user-friendly and reliable trading platform. The platform should allow you to execute trades quickly and efficiently.

• Fees and Spreads: Check the broker's fee structure, including spreads, commissions, and overnight fees. Look for a broker with competitive fees that won't eat into your profits.

• Customer Support: Make sure the broker offers reliable customer support, including email, phone, and live chat. You want to be able to get help quickly if you encounter any issues.

Forex trading involves risk, and it is important to manage that risk carefully. One of the key ways to manage risk in forex trading is to use stop-loss orders. A stop-loss order is an instruction to close a trade when it reaches a certain price. This helps to limit your losses if the trade goes against you.

Another way to manage risk in forex trading is to use leverage responsibly. Leverage allows you to control a larger position than your account balance would allow. However, it also increases your risk. It is important to use leverage in moderation and to understand the risks involved.

Finally, it is essential to have a trading plan and stick to it. A trading plan should outline your goals, strategies, and risk management techniques. It should also include rules for entering and exiting trades. By following a trading plan, you can avoid impulsive and emotional trading decisions, which can lead to costly mistakes.

To succeed in forex trading, you need to be disciplined, patient, and persistent. Here are some tips to help you along the way:

• Learn the Basics: Take the time to learn the basics of forex trading, including how the market works, how to analyze economic data, and how to use technical indicators.

• Develop a Trading Plan: Create a trading plan that fits your personality

Forex trading takes place 24 hours a day, five days a week, with trading sessions starting in Australia and ending in New York. Forex trading is done electronically, with traders using online trading platforms provided by Forex brokers. The trading platforms allow traders to analyze the market, place orders, and manage their trades.

Traders can either buy a currency pair (going long) or sell a currency pair (going short). If a trader buys a currency pair, they are speculating that the value of the base currency will increase against the quote currency. On the other hand, if a trader sells a currency pair, they are speculating that the value of the base currency will decrease against the quote currency.

Forex Strategies

Forex trading involves several strategies that traders can use to make a profit. The most common strategies include:

Scalping – This strategy involves making multiple trades in a short period, usually a few seconds or minutes, with the aim of making small profits from each trade.

Swing Trading – This strategy involves holding a trade for a few days to several weeks, with the aim of profiting from the medium-term price movements.

Position Trading – This strategy involves holding a trade for several weeks to several months, with the aim of profiting from the long-term price movements.

Trend Following – This strategy involves analyzing the market trends and entering trades in the direction of the trend.

Breakout Trading – This strategy involves entering a trade when the price breaks out of a key level of support or resistance.

Comments

Post a Comment